Edgar Brandt Advisory SA is your partner to ensure the success throughout your transactional operations from both Sell-side and Buy-side. EBA brings support to SMEs, large groups, private investors and investment funds.

Our services in M&A – Transaction Services (Sell-side & Buy-side)

Business valuation

Our expertise in business valuation extends to various transactional contexts:

- Valuation review

- Direct sales

- Entry of a new shareholder

- Management buy-out (MBO)

- Family Shareholders’ Agreement

- Expansion / acquisition project

- Fundraising and financing

- Activity split / Spin-off

- Litigation / Divorce

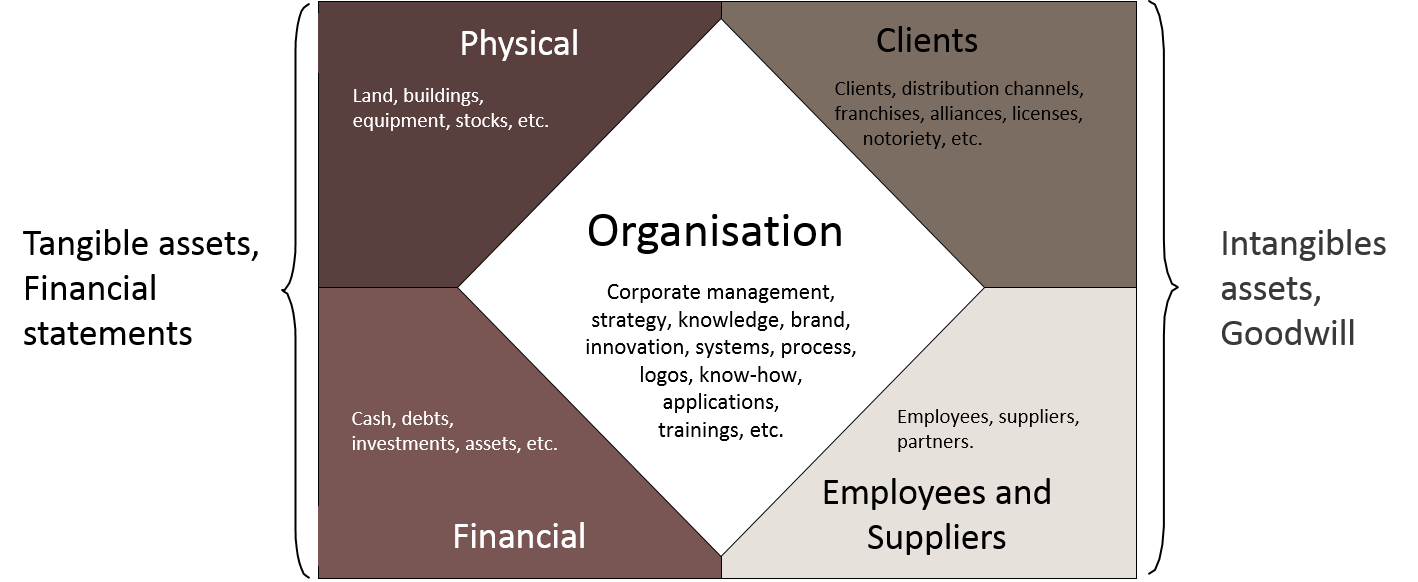

Our vision of the business considers that the value can be found in physical and financial elements but also in intangibles assets like employees, the know-how, the notoriety or privileged relationships with stakeholders. Working on the value, means understanding the whole dynamic of value creation. It can be illustrated as follows:

Transactions (Sell-side)

We assist company owners throughout the business transfer process in order to ensure the transaction’s success :

- Business valuation

- Pondering on the business transfer strategy

- Sale process management

- Preparation of the sale documentation

- Reasearch, contact and follow-up of the prospective buyers

- « Dataroom » implementation

- Management meetings

- Support to negotiation

- Signing and closing

Research and determination of targets (Buy-side & Sell-side)

- Balancing acquisition / selling strategy

- Adapting to your needs in terms of potential synergies

- Identifying and assessing the targeted companies

- Contact anonymously with the identified targets

Due Diligence

When assessing a company, EB Advisory teams have capitalized a unique experience in the following Due Diligence services :

- Strategic

- Financial

- Commercial

- Operational

- Organizational

- Coordination of legal and fiscal experts

Post-transaction integration

The EB Advisory teams own a cutting-edge expertise concerning Post transaction integration issues. We suggest you a complete service offer in this matter:

- Identifiying and assessing synergies

- Determining the integrating strategy

- Tracking of risks related to integration

- Assistance to leaders to have a successful and efficient control

- Preparation aimed to guarantee the business continuity while changing governance

Support to negotiation

- Follow-up, analysis and presentation of offers received

- Preparing and assisting during meetings management and on sites meetings

- Analyzing and presentation of the conditions and sale prices given by the potential buyers/vendors

- Coordinate the external advisors(legal and tax) to finalize the structure of the transaction

Contact us